Are you aware of the significant impact business travel has on global networks? It’s more than just hopping on a plane for work purposes. Business travel is about fostering stronger relationships and exploring new markets, ultimately leading to increased opportunities. The definition of business travel goes beyond mere transportation; it encompasses various business activities conducted abroad. Companies, both big and small, rely on these trips to expand their horizons and connect with potential partners. In fact, face-to-face meetings have proven to be vital in building trust and securing lucrative deals. So, if you’re wondering why businesses invest so much in business travel, stay tuned as we unravel its importance and shed light on its many benefits.

Business travelers embark on these journeys not only for professional purposes but also to engage in personal activities alongside their work commitments. Foreign travel opens doors to new experiences while allowing individuals to represent their companies worldwide. With statistics showing a steady rise in international business activity, it’s evident that more organizations recognize the value of hitting the road for growth and success.

So, let’s delve into the world of business travel and discover why it plays such a crucial role in today’s interconnected global marketplace.

Top European Destinations for Business Travel from San Francisco: An Exclusive Guide

London: Thriving Financial Hub and Diverse Industries

- London is a prime destination for business travelers, offering a thriving financial hub and diverse industries.

- The city’s bustling financial district provides ample opportunities for networking and conducting business deals.

- With its vibrant startup scene, London is an ideal place to explore potential collaborations and investment opportunities.

- From finance to technology, fashion to media, the city boasts a wide range of industries that cater to various business interests.

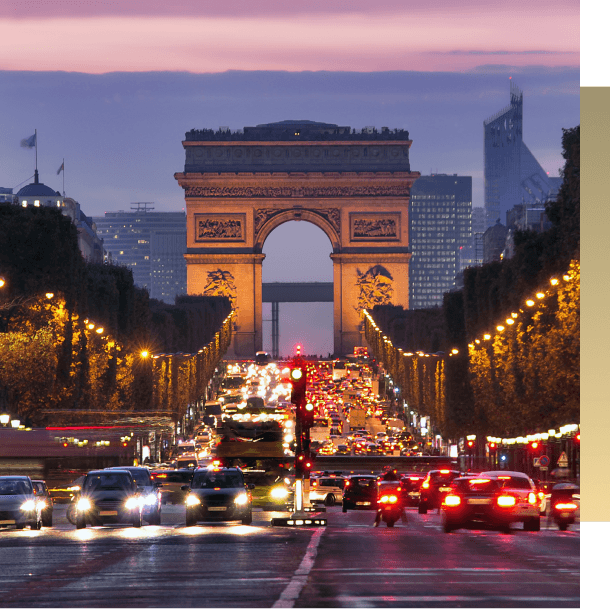

Paris: Culture, Fashion, and Business Opportunities

- Paris combines culture, fashion, and business opportunities into an enticing package for business travelers.

- The city’s prestigious fashion industry attracts professionals seeking inspiration and connections in the world of haute couture.

- Alongside its cultural allure, Paris also serves as a major economic center with numerous multinational corporations headquartered there.

- Business travelers can attend conferences or meetings while enjoying the city’s iconic landmarks like the Eiffel Tower or Louvre Museum.

Frankfurt: Bustling Financial District and Trade Fairs

- Frankfurt is renowned for its bustling financial district known as Mainhattan.

- This area houses some of Europe’s most important banks and financial institutions, making it an ideal destination for those in the finance sector.

- Frankfurt hosts numerous trade fairs throughout the year where professionals can showcase their products or services on an international stage.

- Attending these trade fairs allows business travelers to expand their network while exploring new market opportunities.

IRS Rules and Regulations for Deducting Business Travel Expenses

The IRS has specific rules and regulations in place. Understanding these guidelines is crucial to ensure you claim the appropriate deductions and avoid any potential issues with the IRS.

Ordinary and Necessary Expenses

The IRS allows deductions for ordinary and necessary expenses incurred during business travel. This includes a wide range of costs such as transportation, accommodation, meals, and incidental expenses directly related to your business activities while traveling.

Proper Documentation

To support your deductions for business travel expenses, proper documentation is essential. This means keeping records of receipts, invoices, travel itineraries, and any other relevant documents that demonstrate the purpose and nature of your expenses. Maintaining accurate records will help substantiate your claims in case of an audit.

Eligible Expenses

When deducting business travel expenses, it’s important to know what qualifies as eligible. Here are some key categories:

- Transportation: Deductible transportation expenses may include airfare, train tickets, car rentals, taxi fares, parking fees, and tolls.

- Lodging: Accommodation costs incurred during business travel can be deducted. This includes hotel stays or rental properties used exclusively for business purposes.

- Meals: The cost of meals during business travel is generally deductible but subject to certain limitations. The IRS provides standard meal allowance rates or per diem rates that you can use to calculate your deductions.

- Incidental Costs: Incidental expenses such as tips for baggage handlers or hotel staff can also be included as part of your deductible business travel expenses.

Understanding the tax law surrounding business travel deductions is essential for individuals who frequently travel for work purposes. By familiarizing yourself with the IRS rules and regulations pertaining to deductible business travel expenses, you can ensure compliance with tax requirements and maximize your deductions on your income tax return. Remember to consult a tax professional or refer to the IRS guidelines for specific details and any special rules that may apply to your situation.

Key Factors in Maximizing Tax-Deductible Business Travel Expenses

Planning ahead is crucial for optimizing tax-deductible business travel expenses. By identifying eligible activities in advance, taxpayers can ensure they take full advantage of potential deductions. Here are some key factors to consider:

-

Combining personal trips with business travel

When mixing personal and business activities during a trip, it’s important to note that certain expenses may not be fully deductible. To maximize deductions, it’s essential to separate and clearly document the business-related costs from personal ones.

-

Staying within reasonable limits for meal and entertainment costs

While meals and entertainment expenses can be deductible, it’s vital to exercise caution and adhere to reasonable limits. Keeping receipts and records of these expenses is crucial for substantiating their deductibility.

-

Identifying necessary expenses

To qualify as tax-deductible, travel expenses must be deemed necessary for conducting business. This includes costs associated with transportation, lodging, meals, and incidental expenses directly related to the business purpose of the trip.

-

Properly documenting car expenses

If using a personal vehicle for business travel, taxpayers should maintain detailed records of mileage or actual car expenses incurred during the trip. These records are essential when calculating the deduction amount.

-

Retaining receipts and invoices

It is imperative to keep all relevant receipts and invoices as proof of incurred expenses during business travel. These documents serve as evidence for claiming tax deductions accurately.

Maximizing tax-deductible business travel expenses requires careful planning, documentation, and adherence to applicable regulations. By following these key factors, individuals can minimize their tax burden while ensuring compliance with tax laws related to travel deductions.

Defining Business Travel and its Relevance to Companies

Business travel, simply put, refers to journeys undertaken primarily for work-related purposes. It plays a crucial role in enabling companies to expand their reach, establish partnerships, and explore growth opportunities. Effective management of business travel contributes significantly to the overall success of a company.

Business travel is not just about employees hopping on planes or trains; it serves as a catalyst for growth and development. By venturing into new territories, companies can tap into untapped markets and increase their customer base. This expansion opens doors to fresh revenue streams and enhances the company’s bottom line.

Furthermore, business travel allows companies to forge valuable partnerships with other organizations. Through face-to-face meetings and networking events, businesses can build trust and establish mutually beneficial relationships. These collaborations often lead to joint ventures, strategic alliances, or even mergers and acquisitions that drive innovation and foster long-term success.

Managing business travel effectively is essential for companies aiming to maximize their returns on investment. By implementing streamlined processes and utilizing technology solutions, businesses can optimize costs associated with transportation, accommodation, and meals during trips. Efficient planning ensures that employees can focus on their work while minimizing disruptions caused by logistical challenges.

Conclusion

So, there you have it – some valuable tips for ensuring compliance with IRS regulations on business travel deductions. By understanding the rules and regulations set forth by the IRS, you can maximize your tax-deductible business travel expenses while avoiding any potential pitfalls.

First and foremost, familiarize yourself with the top European destinations for business travel from San Francisco. This exclusive guide will help you plan your trips efficiently and make the most of your deductible expenses.

Next, it’s crucial to grasp the IRS rules and regulations surrounding deducting business travel expenses. Knowing what is considered a legitimate deduction and keeping accurate records will ensure that you stay on the right side of the law while saving money.

To maximize your tax-deductible business travel expenses, consider key factors such as transportation costs, accommodation, meals, and other incidental expenses. By carefully tracking these expenditures and ensuring they are directly related to your business activities, you’ll be able to claim them as deductions without any issues.

Understanding how business travel is defined and its relevance to companies is also essential. By clearly establishing that your travels are necessary for conducting business operations or pursuing new opportunities, you’ll strengthen your case for claiming deductions.

In conclusion, following these tips will not only help you comply with IRS regulations but also ensure that you take full advantage of available deductions. So go ahead and plan those trips strategically while keeping E-A-T in mind – Expertise, Authoritativeness, Trustworthiness – so that your records stand up to scrutiny if ever audited.

Are You Ready to Jet Off in Business Class Without Breaking the Bank?

At All Business Class, we’re not just about flights – we’re about crafting unforgettable journeys. Whether you’re dreaming of sinking your toes in the sand of a tropical island, traversing the grandeur of Europe, savoring a culinary odyssey in Asia, or setting sail on an idyllic ocean cruise, we’re here to turn your dream into reality.

But why stop at personal adventures? If your company is gearing up for an international conference or a critical overseas meeting, let us make it seamless for you. We specialize in crafting the finest corporate travel experiences, guaranteeing top-notch business-class flights and unbeatable pricing for your team.

Remember, we’re not just planning a trip but curating your next unforgettable story. To help us tailor the perfect experience for you, we’re eager to understand your unique travel needs and desires. Choose your dream destinations, and we’ll handle the rest!

Whether you prefer an in-person visit to our office, a quick call to us at (800) 769-7857, or simply filling out our online contact form, we are at your disposal. We’re ready to discuss everything from individual to group pricing, itinerary options, and the best deals on business-class flights.

Your dream destination awaits, and at All Business Class, we can’t wait to help you plan and book the journey of a lifetime!